The ongoing battle surrounding Tesla’s stock amidst aggressive short-selling has raised significant concerns regarding the company’s future. This financial conflict has ignited discussions around market manipulation and the viability of Tesla’s business model. As investors weigh their options, Musk finds himself at the forefront of defending the company’s valuation and strategy against these market challenges.

Strategic Reactions to Market Pressures

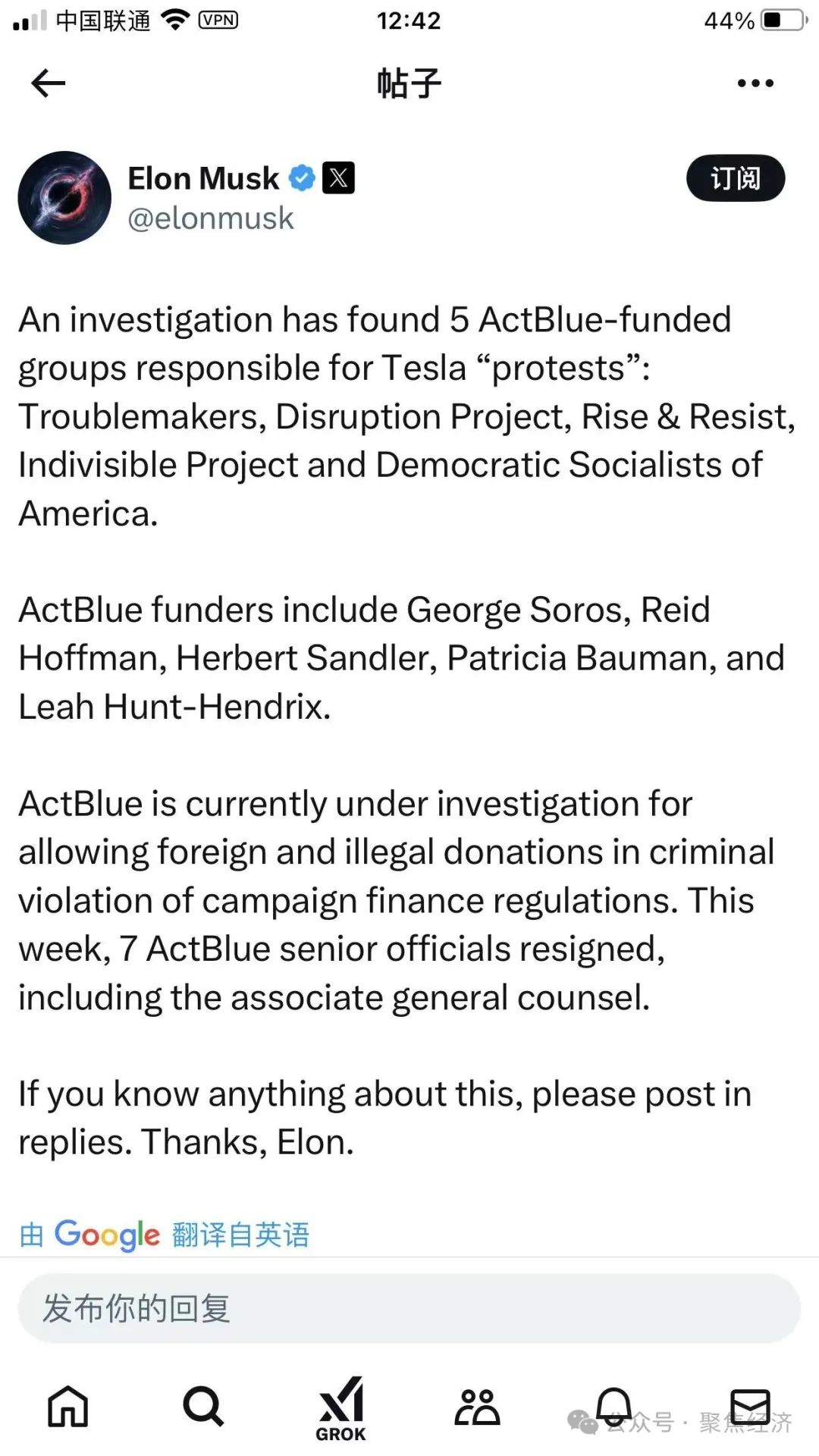

Tesla’s response to these market pressures has included significant investments in innovation and maintaining production efficiencies. Musk’s approach to public communication through social media reflects his intention to reinforce investor confidence and manage public perception amidst the storm of negative narratives.

The stakes in this financial battle are high, not just for Tesla but also for the broader EV market, which is increasingly competitive. With multiple players entering the electric vehicle segment, Tesla must demonstrate resilience and adaptability to retain its market leader position.

In conclusion, as Tesla wrestles with these short-selling pressures orchestrated by influential investors, it’s essential for the company to refine its strategies and organizational resilience to navigate through these turbulent waters. The financial outcome will not only affect Tesla but also reshape the dynamics of the electric vehicle market, with potential implications for innovation, consumer choices, and investment strategies.