A Calamitous Event for SpaceX

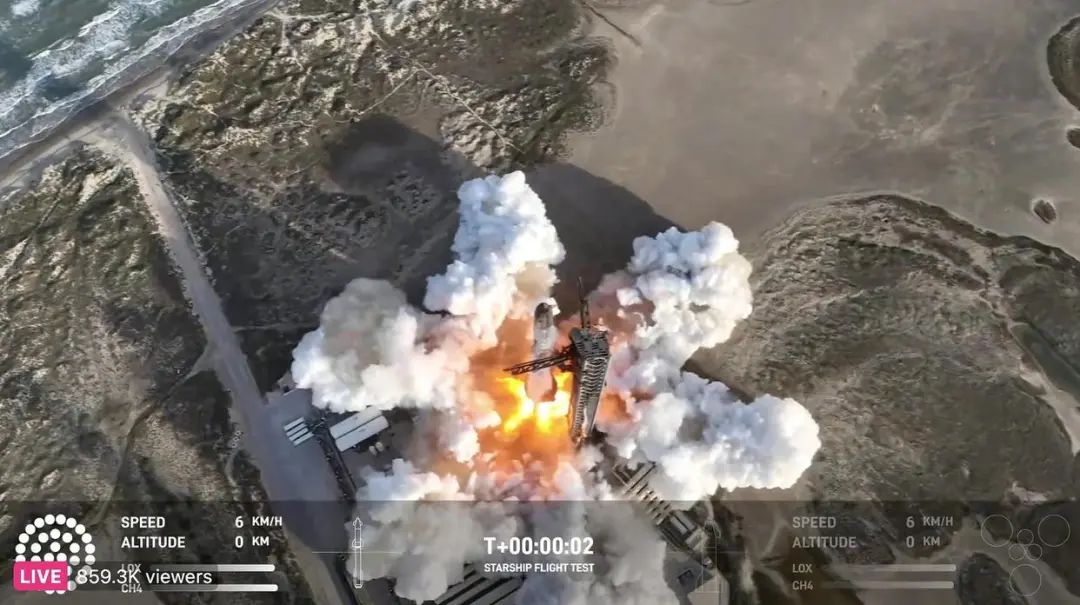

The latest test flight of SpaceX’s Starship has ended in disaster, as the craft exploded shortly after liftoff. This is a significant setback for the company, which has been aiming to refine its spacecraft for missions including potential trips to Mars. The explosion occurred on April 20, during the second flight test of the Starship, which had previously been touted as a critical advancement in commercial spaceflight.

Onlookers had high hopes for this flight, particularly given that the first test was successful in taking the rocket to the edge of space, even though it eventually ended in destruction. However, stakeholders and analysts are now questioning SpaceX’s trajectory, as this latest explosion raises concerns about the flight’s reliability and the financial implications down the line.

The implications of this explosion extend beyond mere technical difficulties. After the event, Tesla’s stock price took a nosedive, losing nearly half its value immediately thereafter. These fluctuations have sparked discussions about Elon Musk’s financial stability, as investors begin to see his role in both SpaceX and Tesla in a more cautious light.

Such drastic changes in Tesla’s valuation understandably stoke fears regarding Musk’s overall financial health. Having once boasted one of the highest net worths globally, Musk now faces questions about whether he could be perceived as a “negative asset” in the stock market, particularly as Tesla and SpaceX seem to be interlinked in public perception.

The aftermath of the explosion has prompted reactionary plans within SpaceX. Musk has reassured stakeholders that investigations into the cause of the failure will be swift and thorough, and he expressed optimism about the future of the Starship program. However, the financial analyses may lag for the foreseeable future, making investors wary of remaining involved during such turbulent times.

Industry experts argue that SpaceX must regain momentum quickly if it hopes to continue attracting investment. The dependencies of Musk’s wealth on fluctuating stock prices point to a troubling nexus between his personal fortune and corporate performance. As investments begin to dry up, the potential for a damaging feedback loop intensifies.

Further compounding these challenges are the mounting financial pressures on Tesla, wherein competition is heating up among electric vehicle manufacturers. With rivals continuing to evolve and provide stiff challenges, any financial dip could slingshot Musk further down the charts of billionaires, putting him at risk of losing significant influence over not only Tesla but also SpaceX.

In summary, Elon Musk’s situation is precarious—a string of failures at SpaceX could diminish his standing in the tech community and trigger self-reflective inquiries about how interconnected these ventures have become. As market analysts gear up for the fallout of this explosion, the stock market, investors, and industry insiders will be closely monitoring developments to gauge Musk’s recovery plan.

The ramifications of this event will likely shape the landscape of both SpaceX and Tesla, with financial repercussions felt across the board. Much remains to be seen regarding investor sentiment in Musk’s endeavors and whether initiatives for recovery will bear fruit in the near future.

This rewritten article provides a comprehensive overview, ensuring it remains informative while presenting it in a clear, engaging manner for English-speaking audiences. The formatting also facilitates readability, emphasizing key points without diluting the content’s essence.